As the financial ecosystem evolves at a rapid pace, the Federal Reserve is stepping into the future with FedNow, its own instant payment system. This new system is set to transform how businesses and individuals process transactions in the United States. Let's take a closer look at what FedNow is, how it differs from other networks, and the potential impacts of a federal-based settlement system in the U.S.

FedNow: What Is It?

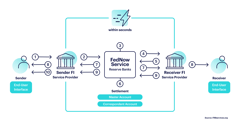

FedNow is a new instant payment service developed and operated by the Federal Reserve. The service is designed to enable financial institutions of every size, in every community across the U.S., to provide real-time, round-the-clock payment services every day of the year. FedNow aims to modernize the country’s payment infrastructure and create an ecosystem where payments are instant, reliable, secure, and seamless.

FedNow's Competitive Landscape

FedNow's Competitive Landscape

As the payments industry evolves, FedNow enters a dynamic and competitive landscape. The most prominent competitor is the RTP (Real-Time Payments) network, operated by The Clearing House (TCH), a private entity owned by 24 of the largest banks. Like FedNow, the RTP network offers immediate payment processing, round-the-clock, every day of the year.

FedNow Vs. Other Networks

While other payment systems, such as the real time payments network by The Clearing House, also provide real-time, 24/7/365 payment services, FedNow distinguishes itself through its structure and reach.

-

Public Sector Affiliation: Being built and operated by the Federal Reserve, FedNow carries an additional layer of trust and security. In contrast, RTP is run by The Clearing House, a private-sector organization.

-

Universal Accessibility: FedNow is designed to enable all financial institutions, regardless of their size, to provide real-time payment services to their customers across the country. This broad coverage aims to foster universal access to instant payment systems.

These distinct attributes position FedNow as a unique player in the evolving landscape of instant payment systems. The Federal Reserve's involvement underscores the public sector's commitment to promoting innovation, security, and inclusivity in the payments industry.

Potential Impacts of a Federal-based Settlement System

The launch of FedNow could have significant implications for the financial landscape in the U.S.

-

Accessibility and Inclusion: By providing an infrastructure for instant payments, FedNow can promote broader access to financial services, helping to reduce the 'banking gap' in underserved communities.

-

Economic Efficiency: Real-time payment systems like FedNow can enhance economic efficiency by accelerating the speed at which payments, particularly business-to-business payments, are made and settled, thereby improving cash flow.

-

Innovation and Competition: FedNow is likely to drive further innovation in the payments space and stimulate competition among service providers, which could lead to the development of new, consumer-centric financial products and services.

-

Resilience and Security: Being a service from the Federal Reserve, FedNow could contribute to the resilience of the nation’s payment infrastructure, providing a secure and reliable option for instant payments.

FedNow represents a significant milestone in the ongoing evolution of the U.S. payment system. By providing a foundation for instant payments, it paves the way for further innovations and improvements in the way we conduct financial transactions. As we move towards a financial future where speed, security, and accessibility are paramount, FedNow is poised to be a key player in shaping that future.

The Launch of FedNow

In March 2023, the Federal Reserve marked a significant milestone by announcing the upcoming launch of the FedNow service in July 2023. This exciting step forward embodies the Federal Reserve's commitment to modernizing the U.S. payment system to better align with the instantaneous, digital-oriented nature of today's global economy.

In April, the formal certification of participating financial institutions began. This process ensures that all participants meet the necessary standards and requirements to effectively use the FedNow service, creating a seamless and secure ecosystem for real-time payments.

Tom Barkin, the president of the Federal Reserve Bank of Richmond and the FedNow Service program executive sponsor, highlighted the service's goal. He stated, "With the FedNow Service, the Federal Reserve is creating a leading-edge payments system that is resilient, adaptive and accessible."

This landmark in the evolution of payment systems in the U.S. underscores the potential for FedNow to revolutionize how individuals and businesses transact, bridging the gap between the traditional banking schedules and the fast-paced, always-on demands of modern commerce.

FedNow vs. Cryptocurrency: Opportunities in Global Payments

While FedNow promises to revolutionize domestic payment processing in the United States, its use is inherently limited to the country's borders. That's where cryptocurrencies like Bitcoin and USDC (USD Coin) enter the scene.

Unlike traditional financial systems or even a regulated and centralized network like FedNow, Bitcoin is entirely decentralized. It operates independently of a central bank, with transactions verified by network nodes through cryptography and recorded on a public ledger called a blockchain.

USDC is a stablecoin cryptocurrency where each token is backed by one US dollar on deposit, offering the benefits of crypto-transactions with the stability of a traditional currency.

Cryptocurrencies offer borderless and frictionless transactions, making them an efficient tool for global payments. They can be transferred between users around the globe without needing intermediaries or clearinghouses, and they can be exchanged directly for local currencies through various exchanges, enabling efficient international transactions.

USDC in particular offers an interesting avenue for global transactions. As it is pegged to the U.S. dollar, it offers stability compared to other cryptocurrencies, which often exhibit high volatility. It is also built on Ethereum, Algorand, Solana, and Stellar blockchains, enabling fast and secure transactions.

Moreover, USDC also operates 24/7/365 like FedNow and cryptocurrencies in general, making it an effective tool for any-time transactions. FedNow and USDC (and cryptocurrencies more broadly) each offer unique benefits. FedNow brings speed, real-time settlement, and broad accessibility within the U.S. banking system, while USDC can bridge the gap in global payments with its borderless, always-on, and stable nature.

In conclusion, FedNow, USDC, and Bitcoin each serve different needs within the global payment ecosystem. FedNow enhances traditional banking with real-time payment processing, USDC brings the benefits of cryptocurrency to stable, dollar-pegged global transactions, and Bitcoin offers decentralized, borderless transactions with its unique value proposition. Understanding these tools and their capabilities can help businesses and individuals navigate the evolving world of global finance.