Stablecoins play a crucial role in the cryptocurrency ecosystem, offering a safe haven from the volatility of other crypto assets. As high liquidity tokens, they are widely used on decentralized exchanges and are crucial for trading and hedging, often used as a barrier to crypto volatility. Two leading stablecoins in the global commerce are USD Coin (USDC) and Tether (USDT), both pegged to the U.S. dollar. In this blog post, we will delve into the key differences between USDC and USDT, focusing on their respective stablecoin issuers, availability, and adoption.

Stablecoin Issuers and Reserves

USD Coin (USDC) is issued by Circle, a U.S.-based financial technology firm. It is an ERC-20 token that is backed by U.S. dollar reserves held in regulated U.S. financial institutions. With Circle as the USDC issuer it guarantees that for every USDC token minted, there is an equivalent U.S. dollar held in reserve, ensuring a 1:1 peg - there are no other USDC issuers. If you'd like to learn more about the three entities that create the USDC ecosystem, read our article on Circle USDC and Centre.

Tether (USDT), on the other hand, is issued by Tether Limited, a company connected to the Bitfinex exchange. Initially backed 1:1 by U.S. dollars held in reserve, USDT's backing now includes a mix of corporate bonds, precious metals, Bitcoins, and other investments. The composition of Tether's reserves has been a subject of debate, raising concerns about its stability.

Network Native Availability

Here's a comparison (as of October 23, 2023) of the networks that both stablecoins operate on natively.

| Network | USDC | USDT |

| Algorand | Yes | Yes |

| Arbitrum | Yes | |

| Avalanche | Yes | Yes |

| Base | Yes | |

| Bitcoin | Yes | |

| Ethereum | Yes | Yes |

| EOS | Yes | |

| Flow | Yes | |

| Hedera | Yes | |

| Kava | Yes | |

| NEAR | Yes | |

| Noble | Yes | |

| Optimism | Yes | |

| Polkadot | Yes | Yes |

| Polygon | Yes | Yes |

| Solana | Yes | Yes |

| Stellar | Yes | |

| TRON | Yes | Yes |

| Tezos | Yes |

Company Headquarters

Given the differences in domicile, USDC and USDT are subject to different regulatory environments. USDC, issued by Circle, a U.S.-based financial technology firm, benefits from being subject to stringent American regulations. As a result, Circle operates within a well-regulated framework that inspires trust among investors and ensures compliance with U.S. laws.

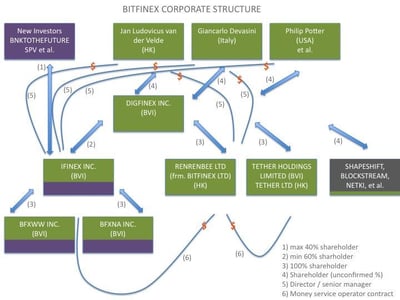

On the other hand, USDT is issued by Tether Limited, a company connected to the Hong Kong-based Bitfinex exchange and its parent company, iFinex Inc. Founded in Hong Kong and registered in the British Virgin Islands, USDT may not face the same level of regulatory scrutiny as its U.S.-based counterpart. Here is an organization chart that from a NY AG filing:

This difference in domicile and corporate structure, combined with the concerns about transparency and audits, may give some investors a preference for USDC's American choice over USDT's Hong Kong-based operations for exploring one of the many stable coin use cases.

This difference in domicile and corporate structure, combined with the concerns about transparency and audits, may give some investors a preference for USDC's American choice over USDT's Hong Kong-based operations for exploring one of the many stable coin use cases.

Adoption and market presence

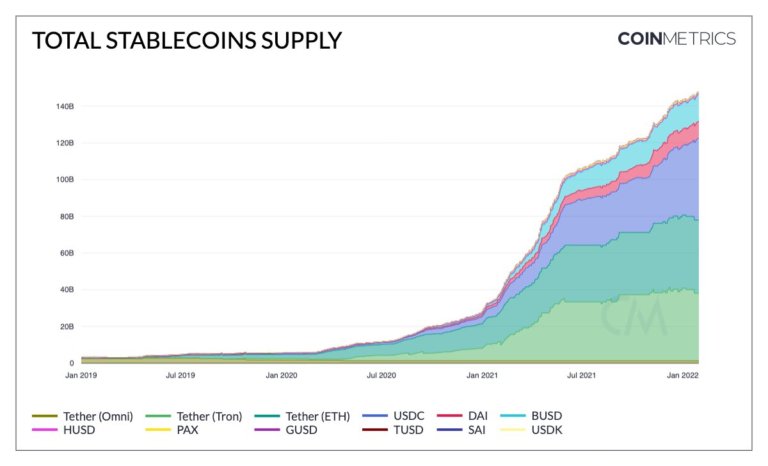

USDT was introduced in 2014 and has a longer history in the market, which has contributed to its larger market capitalization. As one of the earliest stablecoins, it became widely used for trading and settling transactions on various cryptocurrency exchanges. Its high liquidity and established presence made it a popular choice among users in the digital assets market.

On the other hand, USDC was introduced in 2018 by Circle and Coinbase, entering the market with a strong backing from reputable companies. Despite its relatively recent introduction, USDC has seen rapid growth in adoption, thanks to its transparency, regulatory compliance, and solid backing as a non-volatile digital currency. As a result, it has become a popular alternative for those seeking a more transparent and regulated stablecoin in the rapidly evolving world of cryptocurrencies.

While USDT maintains a larger market presence and high liquidity, USDC's growing adoption and strong foundations make it a formidable contender in the digital assets market.

Source: CoinMetrics blog

Source: CoinMetrics blog

Regulatory compliance

USDC is widely regarded as a more regulated and compliant stablecoin compared to USDT. Circle adheres to strict regulatory guidelines and follows U.S. financial regulations, which has played a significant role in USDC's growing adoption.

USDT, on the other hand, has faced scrutiny from regulators and has been subject to legal actions. Concerns over Tether Limited's reserve backing and transparency have led to questions about its regulatory compliance.

A recent development that has impacted the use and perception of Tether (USDT) is the announcement by the Canadian Securities Administrators (CSA). The CSA issued guidance stating that stablecoins like USDT could be considered securities under certain circumstances, which led to increased scrutiny and regulatory pressure.

In response to the CSA's announcement, many Canadian cryptocurrency exchanges decided to delist USDT from their platforms. This move was driven by concerns that continuing to list USDT could potentially violate securities regulations, given the lack of transparency surrounding Tether's reserve backing and its history of legal challenges.

This development has further differentiated USDC and USDT, as USD Coin (USDC) has not faced similar delistings. USDC's strong regulatory compliance and transparency have enabled it to maintain its listing on various exchanges, both in Canada and globally, without raising concerns from regulators.

The CSA requires that trading platforms permit these tokens to be sold or bought only if their reserves consist of highly liquid assets such as cash. These reserves should also be held with a qualified custodian and should be subjected to monthly reviews by independent auditors. The notice from the CSA included a recognition of use cases for stablecoins such as payments and volatility hedging. However, the CSA still considers stablecoins riskier than fiat currency.

Conclusion

Both USDC and USDT offer users the stability of the U.S. dollar in the volatile world of cryptocurrencies. However, the key differences between the two lie in their issuance, transparency, and regulatory compliance. USDC stands out as a more transparent and regulated option, backed by reputable institutions, while USDT maintains a larger market presence. When choosing between USDC and USDT, consider your priorities in terms of stability, transparency, and compliance to make the best decision for your needs.

If you're feeling lost in what is a stablecoin, how to use them, or which one to use then book a meeting with our team! We're more than happy to discuss how our Embedded Finance platform is able to help enable a wide range of use cases.