The “crypto winter” is officially upon us. Although never fun, in this piece we explore the opportunities that downturns have to offer for those with the creativity and sticking power to see matters through to the other side.

TL;DR: Now is not the time to abandon crypto but rather to position your business for the next bull run by building through the dip.

Getting focused when others are fearful

Investopedia defines a bear market as “when a market experiences prolonged price declines”. In the context of crypto, analysts tend to look to the price of bitcoin (BTC) to determine overall market sentiment.

At the time of writing, BTC is nearly 70% down from its All-Time High (ATH) of USD$69,045 in November 2021. The pain is being felt across the board with Ethereum (ETH) down nearly 77%, and Solana taking an 86% dive from ATHs. The widespread red across the charts is not a pretty sight for the faint of heart. But what does it all mean for crypto and your business?

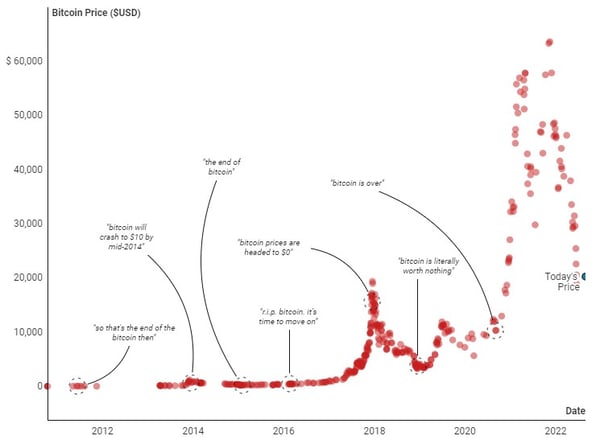

Bitcoinisdead.org is a tongue-in-cheek project that compiles the various obituaries that have been penned in Bitcoin’s name and published in mainstream media outlets over the years. With each headline plotted along the axis of Bitcoin’s meteoric growth, the project sets today’s price action in a larger context of crypto’s growing relevance. That said, staying calm amidst the storm is easier said than done.

Bitcoinisdead.org is a tongue-in-cheek project that compiles the various obituaries that have been penned in Bitcoin’s name and published in mainstream media outlets over the years. With each headline plotted along the axis of Bitcoin’s meteoric growth, the project sets today’s price action in a larger context of crypto’s growing relevance. That said, staying calm amidst the storm is easier said than done.

No Time to Hibernate

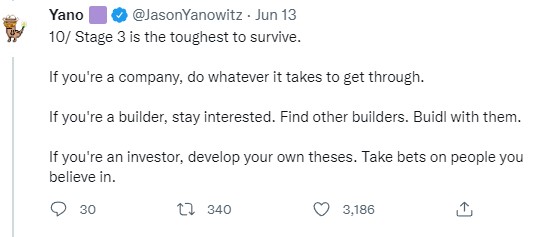

Blockworks’ Co-founder, Jason Yanowitz, published a series of tweets that set out the three stages of a bear market. In it, he warns of the inevitable temptation to stop paying attention to DeFi as the crypto winter bites and fatigue sets in. The key takeaway for builders and investors alike is not to drop the ball on the most important economic and technological shift of our time.

History is littered with examples of era-defining brands that not only refused to walk away when the markets ran cold, but that turned the moment to their advantage. From Microsoft to Apple; General Motors to Uber and CNN to WhatsApp, each of these businesses anticipated broader underlying trends in the products and services they built, thereby successfully positioning themselves ahead of the oncoming bull run.

History is littered with examples of era-defining brands that not only refused to walk away when the markets ran cold, but that turned the moment to their advantage. From Microsoft to Apple; General Motors to Uber and CNN to WhatsApp, each of these businesses anticipated broader underlying trends in the products and services they built, thereby successfully positioning themselves ahead of the oncoming bull run.

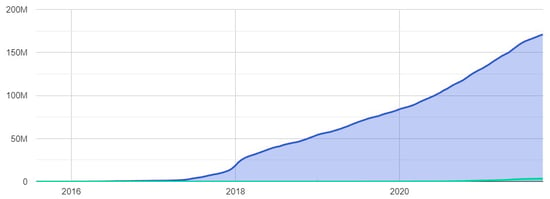

Active Ethereum Addresses

And the signals are all there for the market to turn bullish once again. By the end of next year alone, another 100–200 million new wallet holders are expected to enter crypto. Overall, the sector is still poised for a stunning ~56% Compound Annual Growth Rate (CAGR). Lower crypto prices mean lower barriers to entry and greater accessibility for the hundreds of millions of people who have yet to enter the space. We’ve seen this dynamic play out historically, with net new customers flooding in during bear markets.

Pivoting towards greater accessibility is what ultimately defined success for many of the brands that were able to capitalize during previous downturns. In 1975, Microsoft launched the “Personal Computer”, paving the way for a technological revolution within homes and offices around the world. The email marketing service, Mailchimp, grew its customer base by over 500% in 2001 by offering a freemium service. And in 2008, Airbnb pioneered a cheaper alternative to staying in hotels for people looking for short-term stays, shortly before becoming a global brand. There will always be those that doubt technology!

|

There is no reason anyone would want a computer in their home

- Ken Olson, Chairman and Founder of Digital Equipment, 1977 |

|

There's no chance that the iPhone is going to get significant market share

- Steve Ballmer, Microsoft CEO, 2007 |

|

I would not be surprised if [Bitcoin] is not around in 10 or 20 years

- Warren Buffett, Berkshire Hathaway CEO, 2014 |

To combat the doubters, just remember that 18–44 year-olds are continuing to covet crypto as their number one investment option of choice, demand remains strong over the mid to long term. If your business succeeds in enabling users to buy in at the bottom and have access to wealth-building opportunities, you will be set for an engaged and loyal customer base. The key to navigating the depths of the crypto winter, it would seem, is in staying warmed by the bigger picture.

Bullish on Crypto-Led Growth

Each cycle presents unique challenges and opportunities. While it is true that this particular bear market also coincides with crypto’s first major macroeconomic downturn, the overall outlook for the industry has perhaps never looked sunnier. The clamouring of governments to introduce taxes and regulations as well as unprecedented levels of institutional investment in the space, are just some of the bullish signals that tell us that crypto is not going anywhere.

Indeed, now is the time the build. This bear market offers an unparalleled opportunity for you to get your product into shape before markets thaw into the next bull run. The good news is, there is no need to go it alone.