As technology advances, online payments and financial transactions are becoming more integral to business operations. Managing these processes efficiently is crucial for any

company. Payment as a Service (PaaS) is a popular solution that offers a streamlined approach to handling payments, but is it the best fit for your business?

|

“Payment operations and a company’s financial infrastructure is more complex and diverse than ever. And it’s no longer just about making the numbers make sense – it’s also about positioning your business with a competitive advantage.” - Lee Cocking, Chief Product Officer. Cybrid |

Payment as a Service is one option businesses have to provide their customers with the payment options they prefer with minimal expenditures and effort on their part. However, as with all products and services, PaaS has limitations too.

In this article, we’ll explore the ins and outs of payment as a service. What you’ll find here:

- What is payment as a service?

- How does PaaS work?

- Who uses PaaS

- Potential limitations of payment as a service

- Signs a business may need more than a PaaS

- An alternative to PaaS

What is Payment as a Service (PaaS)?

Payment as a Service (PaaS) is a cloud-based solution that allows businesses to manage and process electronic payments without the need to build and maintain their own payment infrastructure. In 2022, the PaaS market was valued at $13.88 billion with an estimated CAGR growth rate of almost 16% between 2022 and 2030.

PaaS providers can handle everything from payment gateways and fraud prevention to certain compliance and security requirements, overall simplifying the payment process for many businesses.

For instance, online retailers that want to quickly add new payment options to their online store, in response to customer feedback and demand, may choose a PaaS provider to make these new options happen. Or, for those offering subscription-type services, the company may opt for a PaaS partner to help manage recurring payments.

Examples of well-known PaaS products include:

- Stripe

- Square

- PayPal

- Adyen

How Does Payment as a Service Work?

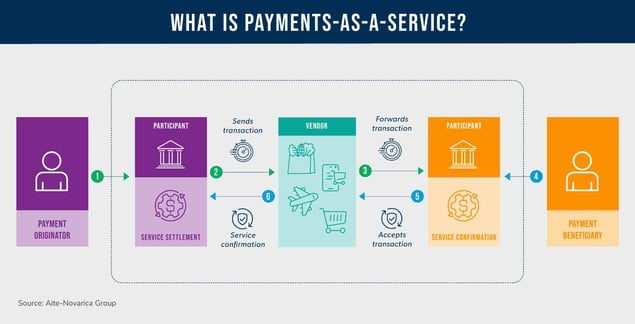

There are many moving parts in payment operations. Here's a simplified breakdown of how Payment as a Service works.

1. Partner with a PaaS provider

To start, a business partners with a PaaS provider that offers a range of payment services. Services range in scope, price, and capabilities.

2. API integration

The PaaS provider gives the business access to an Application Programming Interface (API).

This API integrates the payment services into the business's existing systems such as e-commerce platforms, accounting software, CRM systems, and inventory management tools. The level of integration a PaaS can provide is dependent on their PaaS providers capabilities.

3. Payment processing steps:

-

- Step 1: Authorization. When a customer makes a purchase, the PaaS checks if the customer has enough funds.

- Step 2: Processing. If successfully authorized, the money is transferred from the customer's bank to the business's account.

- Step 3: Settlement. The funds are settled in the business's account, ensuring both the customer and the business are satisfied.

- Step 1: Authorization. When a customer makes a purchase, the PaaS checks if the customer has enough funds.

PaaS supports various payment methods and currencies, making it easy for businesses to handle transactions from credit cards, digital wallets, and international payments. However, not all PaaS solutions can manage every payment option – it’s important to review a potential provider to ensure they have the capabilities you and your customers prefer.

By partnering with a PaaS provider, businesses are able to focus on their core operations while the PaaS handles the complexities of payment processing.

Source: Aite-Novarica Group

Who Uses PaaS?

PaaS is used across a variety of industries due to its flexibility and ease of use while providing the ability to advance financial infrastructure almost instantaneously.

Here are some specific examples of who uses PaaS and how it helps them manage their businesses better and reach new customers.

1. eCommerce and Online Retail

PaaS helps online retailers to handle diverse payment methods and offer customers more payment options. This includes accepting varying credit card types, digital wallets (like ApplePay), and other options into their online stores. By doing so, retailers can quickly adapt to customer preferences and enhance the shopping experience.

2. Subscription-Based Services

Companies offering subscription services, such as streaming platforms, software providers, and membership sites, rely on PaaS to manage recurring billing efficiently. PaaS ensures that monthly or yearly payments are processed accurately and on-time, and is fully automated.

3. Small and Medium Enterprises (SMEs)

SMEs often lack the resources to build and maintain their own payment infrastructure, which can put them at a competitive disadvantage. With a payment as a solution option, they can rely on an affordable and scalable solution that allows these businesses to accept payments online, manage invoices, and ensure secure transactions without significant upfront investment.

Limitations of Payment as a Service Providers

While PaaS offers a number of benefits, it also has certain limitations that businesses (especially those with financial workflows beyond standard payment transactions) should consider before fully investing in a PaaS provider. We discuss six of these below.

1. Lack of Flexibility

PaaS often restricts businesses to specific payment methods and providers. For instance, they may not be able to accept foreign credit cards or enable transactions beyond payments, such as wire transfers.

This lack of flexibility can make it challenging to adapt to new payment technologies or evolve towards customer preferences. Businesses may find themselves limited and end up requiring additional partners to meet all their financial processing needs.

2. Vendor Dependency

Imagine the impact a multi-hour outage would have on a business during a new product launch or highly anticipated sale? Recent outage events have taught us that no system is infallible and relying on a single vendor has risk.

Relying heavily on a single PaaS provider can pose such risks. Businesses may face challenges if the provider experiences outages, increases fees, or fails to update features. This dependency can limit a business's ability to respond to changes and disruptions.

Your Turnkey Payment Infrastructure is Here

Build a compliant, fully customized solution in just 8 weeks.

3. Limited Customization

PaaS solutions often offer limited options for customizing payment workflows and processes. Businesses needing more control over their payment systems, or want to customize their customer experiences, may find a PaaS is inadequate.

4. Higher Costs Over Time

In 2022, American businesses spent over $160 billion on payment processing costs, aka “swipe fees.” The cumulative fees associated with PaaS can add up significantly over time. Transaction fees, currency conversion fees, and other charges can increase operational costs and reduce profit margins.

5. Security and Fraud Prevention

Payment as a service platforms typically offer standard security and fraud prevention features, but these might not be sufficient for businesses with higher security needs or those operating in high-risk industries. For businesses requiring heightened security and fraud prevention, relying solely on PaaS might not provide the necessary protection.

Indications a PaaS Isn’t Best For Your Business

While PaaS can be a great fit for many businesses, there are certain signs that you may need a more robust solution. Here are some indications that PaaS might not meet all your needs:

High-Volume Transactions

If your business processes a high volume of transactions, you might experience scalability issues with PaaS. A more advanced solution can handle larger transaction loads efficiently without compromising performance.

Diverse Payment Methods

Businesses requiring support for diverse payment methods, including cryptocurrencies and wire transfers, may find PaaS too limiting. Look for solutions that can seamlessly integrate various payment options to cater to your customers’ preferences.

International Transactions

If you operate globally, managing multiple currencies and complying with different regulations can be challenging with PaaS. You might need a solution that offers better support for international transactions and local payment methods.

Complex Payment Workflows

Companies with complex payment workflows, such as those needing embedded payment solutions or custom payment routing, may find PaaS too rigid. A more flexible platform can provide the customization required to optimize these processes.

Cost Control

The cumulative fees associated with a payment platform as a service can add up significantly over time. Businesses might find themselves paying more than anticipated due to transaction fees, currency conversion fees, and other charges. A solution that optimizes costs by choosing the most cost-effective providers and routing methods could be more beneficial.

Advanced Security Needs

If your business handles sensitive data or operates in a high-risk industry, you may require more advanced security features than those offered by standard PaaS solutions. Enhanced fraud detection and compliance tools can provide the level of protection necessary for your business.

Custom Integration Requirements

Businesses that need to integrate payments deeply with their existing systems, such as CRM, ERP, or specialized business software, may find PaaS solutions too generic. A more adaptable platform can offer the custom integrations required to streamline operations.

If your business encounters any of these challenges, it might be time to consider a more comprehensive payment solution that can address these specific needs.

|

Read these articles next. We think you’ll like them too. |

The Alternative to Payment as a Service

While payment as a service is a popular choice for handling online payments, businesses looking for more flexibility and advanced features may find a better fit with a Payment Orchestration Platform (POP).

Payment Orchestration Platform (POP)

A Payment Orchestration Platform offers a comprehensive solution for managing multiple payment providers and methods. Unlike PaaS, which often locks businesses into a specific set of services, a POP provides a flexible framework that can integrate various payment options, including traditional methods, cryptocurrencies, wire transfers, and more.

“A payment orchestration platform allows businesses to remain in control of their financial infrastructure and access modern digital options quickly, without the heavy investment costs or time requirements of building these solutions themselves.”

- Lee Cocking, Chief Product Officer. Cybrid

Additionally, POPs support complex payment workflows and offer advanced customizations, enabling businesses to tailor their payment processes to specific needs. A law firm can manage escrow accounts seamlessly and a startup streaming service can set up dynamic billing options directly on their platform.

Moreover, enhanced security and compliance tools further protect transactions and help businesses meet compliance requirements (without the hassle of audits!), making POPs suitable for businesses with high-volume transactions and sensitive data requirements.

In essence, a POP acts as a centralized hub that facilitates the “plumbing” of your payment operations, providing the adaptability and control needed to meet diverse business demands. This makes POP an ideal alternative for businesses that require more than what PaaS can offer.

Payment as a Service vs Payment Orchestration Platform

|

Feature |

Payment as a Service (PaaS) |

Payment Orchestration Platform (POP) |

|

Flexibility |

Limited to specific providers and methods |

Integrates multiple providers and payment methods |

|

Scalability |

May struggle with high transaction volumes |

Efficiently handles large transaction loads |

|

Payment Methods |

Limited diversity (e.g., credit cards, digital wallets) |

Supports a wide range including cryptocurrencies and wire transfers |

|

Customization |

Limited customization options |

Highly customizable payment workflows |

|

Cost Control |

Higher cumulative fees over time |

Optimizes costs through efficient routing |

|

Security |

Standard security features |

Advanced security and compliance tools |

|

Integration |

Basic integration with existing systems |

Deep custom integrations with business software |

|

Autonomy |

Dependent on a single provider |

Freedom to control your financial infrastructure |

Make the Right Choice For Your Financial Operations

Choosing between a payment as a service solution or a payment orchestration platform really comes down to your business needs and the complexity of your finance operations.

If you’re an ecommerce retailer whose financial operations focus primarily on national, purchase-based transactions, a PaaS may be a good fit to start with. However, if your organization deals with more nuanced and regulated financial situations, a payment orchestration platform may be worth considering.

To learn more about the potential of a payment orchestration platform, book a free demo with the team at Cybrid.

Lee Cocking, Head of Product @ Cybrid