Question: Is USDC backed by USD?

Answer: Yes, there is an equivalent amount of USD held in reserves at partnered banks. The breakdown of the reserves is regularly attested and reported.

As the world of cryptocurrency continues to grow, Circle's USDC has emerged as a leading stablecoin for global commerce as it is designed to maintain a 1:1 peg with the US dollar. This means that for every USDC token that is created, there is a corresponding US dollar held in reserve to back it up.

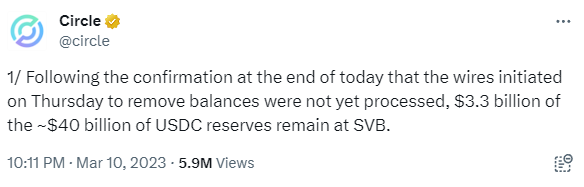

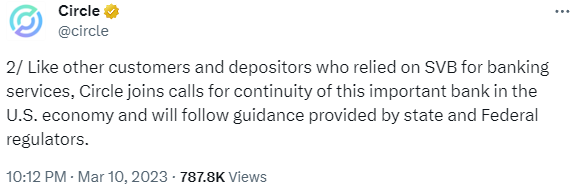

A 2023 development that caused concern among some in the cryptocurrency community was the closure of several banks that Circle USDC has previously worked with. Silicon Valley Bank, for example, closed its doors, leading some to question whether Circle could weather the USDC depeg. However, both the CEO and Circle Twitter accounts were quick to assure the general public and users that Circle Mint and Circle Redeem functionality would continue to run smoothly, thanks in part to its partnerships with major financial institutions.

One of Circle's most significant partnerships is with BNY Mellon, which holds a significant amount of the liquid USD reserves required to maintain the USDC peg. In addition to this, Circle has also partnered with Cross River Bank, which will provide new automated settlement services for USDC transactions. This partnership is particularly noteworthy given the closure of Silicon Valley Bank, which was previously responsible for providing these services.

As of the December 2022 report, some other banking partners that Circle USDC works with include Customers Bank, Citizens Trust Bank and New York Community Bank. Each of these partners plays a critical role in Circle's overall banking infrastructure, helping to ensure that the company can maintain the stability of the USDC peg over the long term.

For individuals who use Circle USDC as part of their cryptocurrency portfolio, it is important to understand the role that these banking partners play in maintaining the stability of the USDC peg. By working with reputable institutions like BNY Mellon and Cross River Bank, Circle can provide its customers with a reliable and stable cryptocurrency that can be used for a wide variety of purposes.

If you're looking to develop a financial application that leverages Circle USDC or any other cryptocurrency, then Cybrid may be the perfect Embedded Finance platform for you. Our end-to-end services make integration easy, with no need to worry about the complexity of banking relationships, multiple vendors, or other technical challenges.

With Cybrid, you can focus on developing your financial application, while we take care of the rest. Our platform provides a wide range of services, including banking infrastructure and partnerships, KYC and AML compliance, and secure storage for digital assets. This means that you can build and launch your financial application with confidence, knowing that everything is taken care of.

One of the key advantages of using Cybrid is the ease of integration. Our platform is designed to be as simple and straightforward as possible, so you can quickly and easily integrate your application or programmable wallet with Circle USDC or any other cryptocurrency. Whether you're a developer, entrepreneur, or established financial institution, Cybrid makes it easy to build and launch a cutting-edge financial application that meets the needs of your customers.

So if you're looking to build a financial application that leverages Circle USDC or any other cryptocurrency, look no further than Cybrid. With our end-to-end crypto service and easy integration, we can help you bring your vision to life and create a truly innovative financial solution that meets the needs of your customers.