In 2023, the crypto community witnessed a phenomenon that reaffirmed the intricate relationships between decentralized finance and traditional banking systems. USDC, a staple stablecoin, momentarily lost its peg, throwing the markets into a temporary frenzy. The collapse of Silicon Valley Bank (SVB) played a crucial role in this occurrence, revealing the vulnerabilities even the most well-regarded digital assets face.

SigNet and SEN: Catalysts Before the SVB Storm

Before the SVB saga unraveled, the cryptocurrency ecosystem was already showing signs of potential turbulence. Signature Bank's SigNet and the Silvergate Exchange Network (SEN) from Silvergate Bank, both critical lifelines for many crypto exchanges, faced shutdown. These networks, pivotal in ensuring seamless crypto-to-fiat conversions, suddenly became unavailable.

The interruptions in SigNet and SEN's operations precipitated a temporary reduction in USDC availability to end-users. These early challenges served as precursors, hinting at vulnerabilities in the financial interplay between traditional banking systems and the dynamic world of crypto.

The Silicon Valley Bank Collapse: A Domino Effect

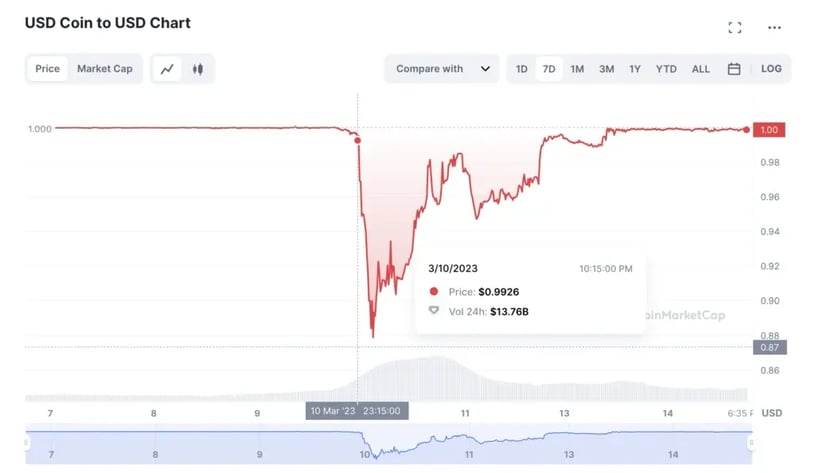

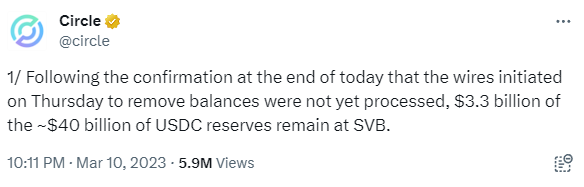

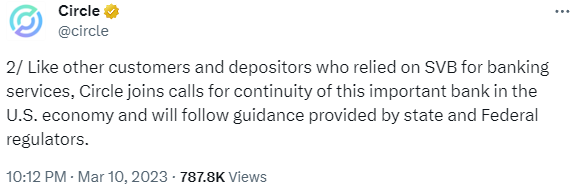

In March 2023, an unexpected series of events tested the resilience and transparency of the crypto industry as Circle USDC, which is designed to mirror the value of the U.S. dollar, saw its trading price fall to an unexpected low of 89 cents on decentralized exchanges such as UniSwap and Curve. The crypto community, always quick to react, began to question the implications for USDC and its holders and were quickly exiting USDC. At the epicenter of this test was Circle, a company celebrated for its unwavering commitment to transparency.

However, the concern was short-lived. The FDIC, recognizing the broader implications of the situation, made an exceptional decision to waive the standard $250,000 insurance limit on deposits at SVB. This move ensured the security of Circle's $3.3 billion, and USDC rapidly regained its $1 peg.

The March 2023 events prompted Circle to fortify its banking partnerships, ensuring a more robust foundation for its operations. In response to the market dynamics, Circle not only expanded its existing relationship with Bank of New York Mellon (BNY Mellon) but also announced a strategic partnership with Cross River in the same month. This move showcased Circle's proactive approach, emphasizing the importance of diversified and strong banking connections to bolster the stability and reliability of their offerings.

In contrast, other stablecoins, shielded by their opacity, were left untouched by the immediate crisis. Yet, their lack of transparency raised broader questions about the future and what challenges might lurk unseen.

Lessons Learned and Looking Forward

The SVB banking crisis of 2023 underscored a significant weak point in the interplay between USD-based stablecoins and the traditional U.S. banking system, with the latter operating on restricted hours. This dichotomy becomes pronounced during weekends when the efforts to restore stablecoin pegs are limited due to the lack of liquidity in purchasing USDC from decentralized exchanges (DEXs) and liquidity pools.

However, the evolution and adoption of U.S. banking settlement changes, such as Real-Time Payments (RTP) and FedNow, could potentially mitigate this weakness. These advancements promise to streamline the reconciliation and settlement processes, ensuring a more seamless financial layer that operates 24/7.