In the world of cryptocurrencies, having an efficient and secure way to on and off-ramp crypto is crucial businesses to be able to service their users' cryptocurrency needs. But what exactly is an on-ramp and off-ramp? An on-ramp refers to the process of converting fiat currency (e.g., USD, EUR) into cryptocurrencies, while an off-ramp is the process of converting cryptocurrencies back into fiat currency. The term "ramp crypto" refers to these processes, which enable users to easily move funds between fiat currency and cryptocurrencies. Various platforms offer innovative solutions for this purpose, with unique on and off-ramp designs. In this article, we will explore different ramp crypto platforms and their features, including open banking APIs, card payment methods, and additional investment opportunities.

What is the Ramping Process?

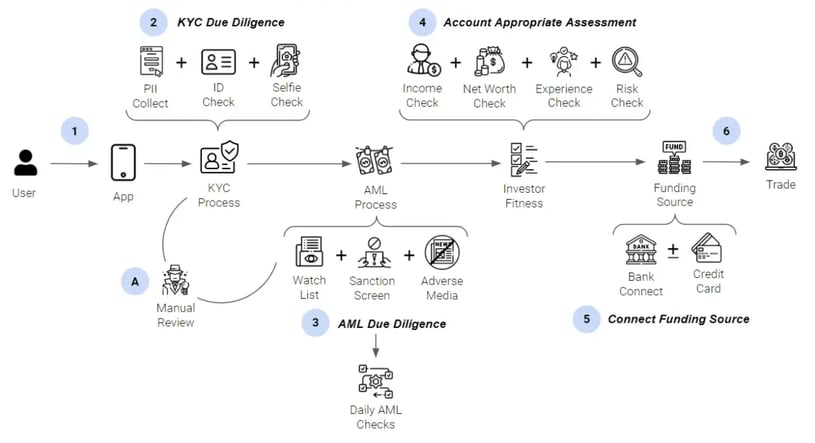

From KYC/AML to Exchanging Crypto The ramping process involves several steps to ensure a secure and compliant conversion of funds between fiat currency and cryptocurrencies. Here is an overview of the typical ramping process:

Performing KYC/AML Checks

Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are essential to comply with regulatory requirements and prevent illegal activities. Users are usually required to provide personal information, such as their name, address, and a government-issued ID, to verify their identity. The forms of identification will be based on the jurisdiction of the user.

Connecting Banking

Users need to connect their bank accounts or cards to the ramping platform. This can be done through open banking APIs or by providing the necessary account/card information. Once connected, users can fund their accounts or withdraw funds to their linked bank accounts. Ensuring funds land in platform FBO accounts is essential to creating trust with end users.

Moving Money

After connecting their bank accounts or cards, users can transfer funds between their bank accounts and the ramping platform. The transfer can be initiated either from the user's bank account or directly through the platform, depending on the specific ramping solution. Depending on the location, there will be different money transfer methods, like ACH and EFT, or Interac E-Transfer.

Exchanging Crypto

Once the fiat funds are available on a platform, exchanging them for cryptocurrencies. The exchange rate will be determined based on market conditions and any applicable fees. For many situations, the orders will be processed through liquidity providers or market makers.

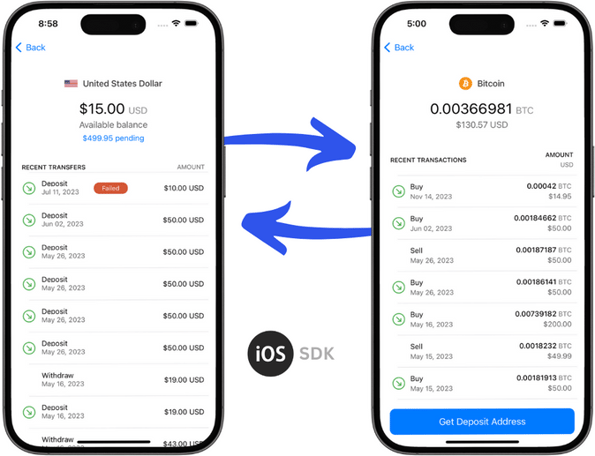

Storing and Withdrawing Crypto

After the exchange is completed, users can store their purchased cryptocurrencies on a platform's wallet as a service (if offered by the platform) or transfer them to an external wallet. When off-ramping, users can sell their cryptocurrencies for fiat currency, which can then be withdrawn to their bank accounts or cards.

The Importance of Ledgering in the Ramping Process

Ledgering plays a crucial role in ensuring the security and transparency of the ramping process. A ledger is a digital record that keeps track of all transactions and balances within the ramping platform. Here's why ledgering is essential in the ramping process:

Transparency and Accountability

A well-maintained ledger ensures transparency by providing a clear record of all transactions. This helps users and regulators to verify the authenticity of transactions and detect any fraudulent activities.

Security and Trust

Ledgering helps maintain the security and integrity of the ramping platform. By keeping track of all transactions, a ledger can help identify any unauthorized access or unusual activities, ensuring the safety of user funds.

Auditing and Compliance

A detailed and accurate ledger is essential for auditing purposes. It allows regulators and third-party auditors to review the ramping platform's operations and ensure compliance with relevant laws and regulations.

Real-time Updates and Monitoring

A well-structured ledger enables real-time updates and monitoring of transactions, making it easier for users and platform administrators to keep track of their funds and activities.

Efficient Dispute Resolution

In case of any disputes or discrepancies, a comprehensive ledger provides a reliable source of information for resolving issues and maintaining user trust.

The different types of ramping solutions

Crypto Exchange APIs

Crypto Exchange APIs, like Coinbase API and Binance API, offer the ability to businesses to swap, but these companies are competing for the same end-user base. Generally when operating on these platforms, they can have a buy/sell spread of up to 2.5%, which may not provide a significant opportunity for revenue generation for the business connecting to them as their pricing will not be competitive.

Liquidity Providers

These providers play a vital role in the ramping process by supplying the necessary liquidity to facilitate smooth transactions between various cryptocurrencies and fiat currencies. Large daily and monthly settlement limits allow them to handle high transaction volumes, but often come with large monthly fees. Making them less then a preferred choice for businesses looking to make irregular or lower volume trades. Some prominent liquidity providers in the crypto industry include Aquanow, Bakkt, and Anchorage Digital.

B2B Exchange Services

Services like MoonPay, ZeroHash, and Ramp Network act as middlemen between liquidity providers and businesses looking for ramping solutions. They often have a hidden spread on the price, which may affect the cost of transactions. A notable drawback of many B2B exchange services is that they typically do not offer UI SDK components or if the do will provide minimal functionality, which can limit the customization and user experience of the ramping process for businesses. As a result, businesses might need to invest additional resources into developing their own user interfaces and integrating these services into their platforms.

Embedded Finance Platforms

Embedded finance platforms provide a comprehensive set of tools and services that enable businesses to integrate financial services, such as cryptocurrency and decentralized finance (DeFi) capabilities, directly into their products. By offering seamless integration and streamlining the process of building and launching compliant crypto products, these platforms help businesses grow in the evolving financial landscape.

We like to think one standout example for Embedded Finance is Cybrid. As a leading crypto service provider, Cybrid empowers businesses to seamlessly integrate cryptocurrency and DeFi capabilities into their products. The platform offers end-to-end services, including access to FBO bank accounts connected to crypto on-off ramps, support for Circle USDC embedded finance use cases, banking infrastructure, and secure storage for digital assets.