As a startup founder or CEO looking to embrace crypto technology, you may be aware of the many benefits it can provide, such as reduced costs, faster transactions, and expanded global opportunities. However, it's important to understand the regulatory landscape around anti-money laundering (AML) to avoid legal and reputational issues.

In this post, we'll cover the top five things you need to know about crypto regulations when launching a crypto product. We'll explore the regulatory requirements, best practices, and technologies you should consider to ensure your product is compliant and secure.

1. Know Your Customer (KYC)

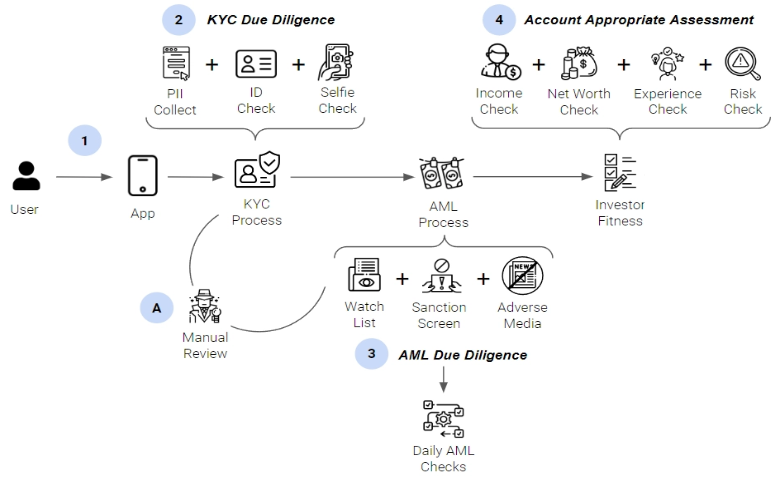

KYC is a critical process in the fight against money laundering and terrorist financing, not just in the crypto space, but in the financial industry as a whole. It involves verifying the identity of your customers and assessing the risks associated with doing business with them.

In recent years, global regulators have placed increasing emphasis on KYC as part of their anti-money laundering efforts. The Financial Action Task Force (FATF), an intergovernmental body that sets international standards for combating money laundering and terrorist financing, has issued guidance on how G7 countries should implement KYC requirements.

To implement AML KYC best practices, you should consider using a third-party KYC api provider that specializes in identity verification. These providers can help you verify customer identities using a variety of methods, including government-issued IDs and biometric data.

When conducting KYC checks, it's important to consider the risk profile of each customer. High-risk customers, such as politically exposed persons (PEPs) and those from countries with a high risk of money laundering or terrorist financing, require more stringent checks.

By conducting thorough KYC checks on all of your customers, regardless of transaction size, you can help prevent your product from being used for money laundering or other illegal activities. This will not only help you comply with AML regulations but also protect your business from legal and reputational risks.

The Importance of Matching KYC Services with Partner Financial Institutions

When it comes to KYC, pricing can vary widely between different providers. However, it's important to remember that the cheapest option may not necessarily be the best option, especially when it comes to partnering with financial institutions.

Partner financial institutions will often have their own specific requirements for KYC, which may include certain checks or verifications. To ensure that your product meets these requirements, it's important to work with a KYC provider that can offer the appropriate level of checks.

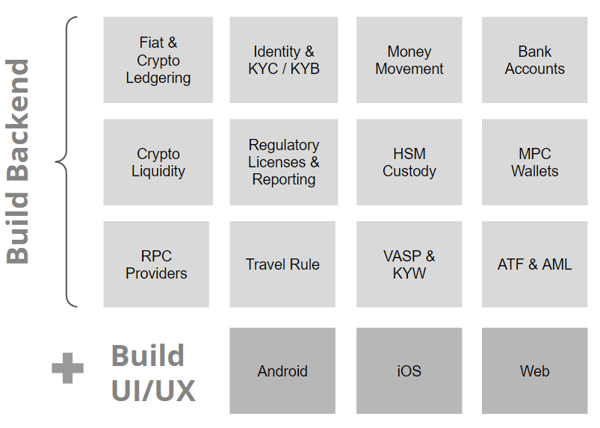

At Cybrid, we understand the importance of matching KYC services with partner financial institutions. Our all-in-one platform is designed for developers, entrepreneurs, and financial institutions to simplify the process of launching compliant crypto products. Our platform provides end-to-end services, including access to FBO bank accounts connected to crypto on-off ramps, support for Circle USDC, banking infrastructure and partnerships, secure storage for digital assets with both custodial and non-custodial wallet options, and KYC and AML compliance.

When evaluating KYC providers, it's important to consider not just the price, but also the ease of integration and the level of checks that are offered. By ensuring that your product meets the KYC requirements of partner financial institutions, you can build trust and credibility with your customers, while avoiding legal and reputational risks.

2. The Travel Rule

The Travel Rule is a regulation that requires financial institutions to collect and share certain customer information when transferring funds between institutions. The rule was first implemented by the Financial Action Task Force (FATF) in 1996 to combat money laundering and terrorist financing.

The Travel Rule is a regulation that requires financial institutions to collect and share certain customer information when transferring funds between institutions. The rule was first implemented by the Financial Action Task Force (FATF) in 1996 to combat money laundering and terrorist financing.

Under the Travel Rule, financial institutions must share information such as the name, address, and account number of the sender and recipient of a transaction. This information must be shared with other financial institutions involved in the transfer, even if they are located in different countries.

In 2019, the FATF issued updated guidance on the Travel Rule to include virtual asset service providers (VASPs), which includes cryptocurrency exchanges and wallet providers. This means that VASPs must also comply with the Travel Rule by collecting and sharing customer information when transferring funds between institutions.

The application of the Travel Rule to crypto has raised several challenges, including the decentralized nature of many cryptocurrencies and the difficulty of identifying and verifying customer information. However, at Cybrid, we have developed a comprehensive suite of tools and services to help businesses comply with the Travel Rule and other AML regulations.

Our platform provides end-to-end services, including ongoing transaction monitoring that incorporates the requirements of the Travel Rule. This enables users to focus on building their applications without worrying about the complexity of multiple vendor relationships or technical challenges.

By partnering with Cybrid, businesses can ensure that they are meeting their AML obligations while also providing a seamless user experience for their customers. Our platform is designed to integrate seamlessly with your existing infrastructure, minimizing the technical complexity of implementing AML checks.

3. Licensing and Legal Requirements

In addition to complying with AML regulations, businesses launching crypto products must also ensure that they have the appropriate licenses, insurances, and other legal requirements in place. These requirements may vary by jurisdiction and can include:

-

Licenses: Many jurisdictions require businesses to obtain specific licenses in order to operate in the crypto industry. These licenses may include money transmitter licenses, virtual currency licenses, or other similar licenses. It's important to research and obtain the appropriate licenses before launching a crypto product.

-

Registrations: Depending on the jurisdiction, businesses may be required to register with specific governmental bodies in order to comply with securities laws. This may include registering as a broker-dealer, investment advisor, or other similar entity.

-

Insurance: Businesses may also need to obtain specific insurance policies in order to operate in the crypto industry. This may include coverage for cyber risks, errors and omissions, or other similar risks.

-

Legal advice: Given the complex regulatory landscape in the crypto industry, it's important for businesses to seek legal advice from experts in the field. This can help ensure that businesses are meeting all relevant legal requirements and can minimize the risk of legal and reputational risks. In addition to complex and costly contracts and agreements.

By partnering with Cybrid, businesses can leverage our expertise and experience to navigate the complex US crypto regulations and Canada crypto regulations landscape in the crypto industry. We work closely with our clients to understand their specific needs and develop customized solutions to help them meet their regulatory obligations and launch compliant crypto products.

4. Documented and Segregated Flows of Funds

Ensuring documented and segregated flows of funds for end users is a key requirement for launching a compliant crypto product. This requirement is designed to prevent commingling of funds and provide transparency to end users, and is often mandated by AML regulations and other legal requirements.

Documented flows of funds require businesses to maintain a record of all transactions, including the source and destination of funds, as well as any relevant KYC and AML checks. This enables businesses to track the movement of funds and identify any suspicious activity that may indicate money laundering or other illegal activity.

Segregated flows of funds require businesses to keep customer funds separate from their own funds, often through the use of FBO accounts. This ensures that customer funds are available for withdrawal or transfer at all times, and reduces the risk of loss or theft of digital assets.

Implementing appropriate accounting practices for documented and segregated flows of funds can be complex and time-consuming, but it is essential for compliance and maintaining customer trust. Failure to implement appropriate accounting practices can result in legal and reputational risks, including fines, legal action, and damage to the business's reputation.

At Cybrid, we understand the importance of documented and segregated flows of funds for end users. Our platform provides fully double ledgered accounting on both fiat and crypto, as well as access to FBO accounts and multiple digital custody options. This enables businesses to keep funds separate and properly documented for end users, while also ensuring the security and integrity of digital assets.

5. Security Considerations

Security is a critical consideration when launching a crypto product. The crypto industry is a prime target for cybercriminals, and businesses must take appropriate measures to protect their customers' digital assets and personal information. Security considerations when launching a crypto product include:

-

Back-end and application security: Businesses must implement appropriate security measures for their back-end systems and applications. This includes implementing firewalls, intrusion detection systems, and other security measures to prevent unauthorized access and protect against cyberattacks.

-

Secure storage: Digital assets must be stored securely to prevent loss or theft. This can include using secure digital custody solutions, implementing multi-signature authentication, and other measures to protect against digital asset theft.

-

Fraud mitigation: Businesses must implement appropriate measures to prevent fraud, including transaction monitoring, identity verification, and other measures to prevent unauthorized access and protect against fraudulent activity. This includes regular reviews of transaction activity, user behavior, and other data to identify potential red flags and prevent fraudulent activity.

-

Common certifications and best practices: Businesses should follow common certifications and best practices to minimize the risk of legal and reputational risks. Some of the common certifications and best practices include SOC 2 compliance, PCI-DSS compliance, ISO 27001 compliance, and ongoing risk assessments.

At Cybrid, we understand the importance of security when launching a crypto product. Our platform provides secure storage for digital assets with both custodial and non-custodial wallet options. Our CTO, Brent Carrara, has extensive experience in the security and intelligence fields, including a Master's degree in Computer Science and Ph.D in Computer and Network Security. He brings his expertise to our platform development, ensuring that we are following industry best practices and implementing appropriate security measures to protect against cyberattacks and other threats.

Partner with Cybrid to Launch Compliant Crypto Products

Launching a compliant crypto product requires businesses to navigate a complex regulatory landscape and implement appropriate measures to ensure security and fraud mitigation. To be successful, businesses must follow common certifications and best practices, implement appropriate security measures, and conduct ongoing monitoring and reporting.

Partnering with a trusted Embedded Finance provider like Cybrid can help businesses launch compliant crypto products with confidence. Our platform offers a comprehensive suite of tools and services, including secure digital asset management, compliance, and scalable infrastructure, to help businesses create cutting-edge financial solutions that meet the needs of their customers.

Our platform includes transaction monitoring and identity verification measures, as well as ongoing monitoring and reporting, to detect and prevent fraudulent activity. We also employ best practices in all areas of development, including end-to-end testing and secure coding practices, to ensure that our platform is secure and compliant.

By partnering with Cybrid, businesses can leverage our expertise and platform to implement appropriate measures and launch compliant crypto products with confidence. Our team of experts works closely with our clients to ensure that they are implementing appropriate security measures and following best practices for launching compliant crypto products.