For fintech startups, setting up the new business can be an exciting and rewarding venture. With the rapid growth of technology and the increasing demand for digital financial services, the fintech industry presents ample opportunities for innovation and success. In this blog post, we will guide you through the essential steps to set up a fintech company in the United States, from choosing the right business structure to registering your company and obtaining the necessary permits and licenses. We will also touch upon various aspects of the fintech landscape, such as personal finance apps, B2B fintech startups, and app development.

Identifying Your Fintech Niche

Before setting up your fintech startup, it's essential to identify your niche within the industry. Fintech startups can cater to various sectors, including personal finance apps, B2B fintech services, and global fintech startup apps. Consider whether you want to compete with traditional financial service providers or focus on a specific market segment with a specific crypto service, such as B2B finance using USDC to USD.

Choosing the Right Business Structure

The first step in setting up a fintech startup is choosing the appropriate business structure. There are four main types of business structures:

-

-

Sole Proprietorship: This is the simplest form of business ownership, with one individual responsible for all aspects of the company. It is easy to set up and requires minimal paperwork, but the owner has unlimited personal liability for business debts.

-

Partnership: A partnership is a business owned by two or more individuals who share in the profits and losses. There are two types of partnerships: general and limited. General partners share equal responsibility and liability, while limited partners have limited liability and are not involved in the day-to-day operations.

-

Limited Liability Company (LLC): An LLC combines the advantages of a corporation and a partnership. It provides limited liability protection for the owners, known as members, and allows for flexible management and taxation options.

-

Corporation: A corporation is a separate legal entity owned by shareholders. It offers the most protection from personal liability but requires more paperwork and formalities, such as holding annual meetings and keeping detailed records.

-

Each structure has its advantages and disadvantages, depending on the specific needs of your financial technology startup.

Registering Your Fintech Startup

Once you've chosen the appropriate business structure, it's time to register your fintech startup. This involves:

-

-

Selecting a business name: Choose a unique and memorable name that reflects your brand and services. Be sure to check if your desired name is available and complies with your state's naming requirements.

-

Registering with the Secretary of State: Depending on your chosen business structure, you will need to file Articles of Incorporation (for corporations) or Articles of Organization (for LLCs) with your state's Secretary of State office.

-

Obtaining an EIN

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax reporting purposes. It is required for most businesses, including fintech startups. For more information on EIN numbers, please refer to our blog post on understanding what is an EIN number.

Acquiring Necessary Permits and Licenses

Depending on the nature of your fintech startup, you may need to obtain various permits and licenses at the federal, state, and local levels. These may include business operation licenses, and industry-specific licenses or certifications. Fintech companies may also need to comply with financial regulations and obtain necessary licenses, such as money transmitter licenses, lending licenses, or investment advisor registrations.

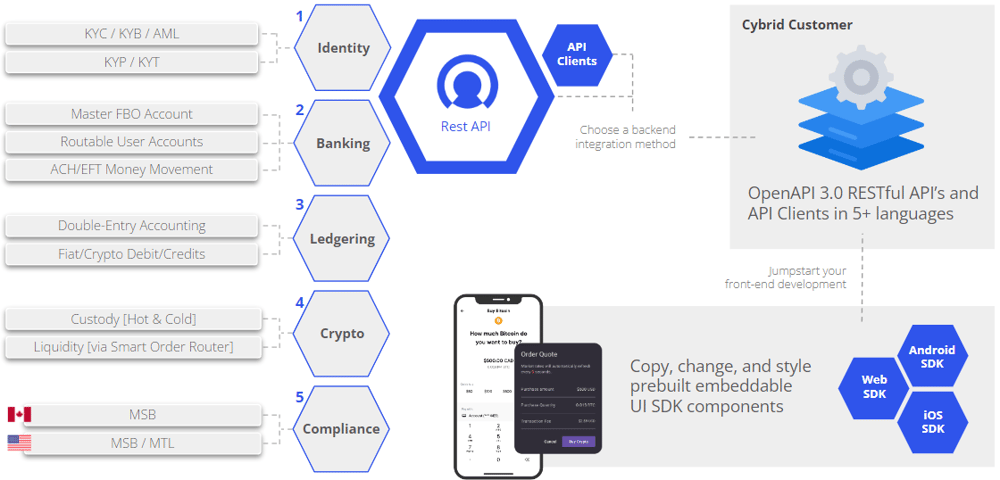

Navigating the complex world of permits and licenses can be daunting, but partnering with a comprehensive embedded finance platform like Cybrid can significantly reduce the burden. Cybrid's platform maintains many of the more expensive and difficult permits and licenses, allowing you to focus on building your fintech startup while remaining compliant with financial regulations.

To ensure compliance, research the specific permits and licenses required for your fintech startup and consult with legal or regulatory experts if needed. Keep in mind that regulations may vary across different jurisdictions, and you must adhere to the specific requirements in each area where you plan to operate. With Cybrid's support, you can confidently navigate the regulatory landscape and establish your fintech startup on a solid foundation.

Assembling Your Team

Building a successful fintech startup requires a skilled and dedicated team. Depending on your niche, you may need to hire app developers, financial experts, sales and marketing professionals, and support staff. When assembling your team, consider the following roles:

- Founders and management: A strong leadership team can set the direction and vision for your fintech startup, making strategic decisions for topics like AML KYC and overseeing the company's growth.

- App developers and engineers: To build and maintain your fintech product or service, you'll need a team of talented developers and engineers with expertise in various technologies, including mobile app development, backend systems, and security.

- Sales and marketing: To promote your fintech startup and attract users, a skilled sales and marketing team can develop and execute strategies for customer acquisition and retention.

- Support staff: Depending on the size and complexity of your fintech startup, you may need additional support staff, such as customer service representatives, human resources, and administrative professionals.

By assembling a diverse team with complementary skills and expertise, you can ensure your fintech startup is well-prepared for the challenges and opportunities in the rapidly evolving financial technology landscape.

Building Your Fintech Product or Service

Developing your fintech product or service, such as a personal finance app or a B2B fintech platform, is a critical step in building your startup. You may choose to develop the app in-house or collaborate with top financial app developers to bring your vision to life. Regardless, consider partnering with Cybrid, a comprehensive embedded finance provider. Cybrid empowers fintech startups of all types to seamlessly integrate cryptocurrency capabilities into their products.

By offering an all-in-one platform designed for developers, entrepreneurs, and financial institutions, Cybrid simplifies the process of launching compliant crypto products and helps businesses grow in the evolving financial landscape. This enables you to focus on building your applications without worrying about the complexity of banking relationships or technical challenges.

Marketing Your Fintech Startup

Promoting your fintech startup is crucial to attracting users and gaining traction in the market. This may involve building a strong online presence, leveraging social media platforms, and networking with industry influencers and potential partners. As you market your fintech startup, consider the added benefits of partnering with Cybrid, a leading embedded finance platform. Cybrid is not only committed to providing best-in-class technical resources but also offers in-depth marketing guides and programs to help accelerate growth for its partners.

By joining forces with Cybrid, you can tap into their expertise and resources, ensuring your startup's marketing efforts are more effective and impactful. Showcase your collaboration with Cybrid to demonstrate your commitment to providing cutting-edge financial solutions that meet the needs of your customers, and leverage Cybrid's reputation and expertise to increase your startup's credibility and visibility.

Conclusion and Next Steps

In conclusion, starting a fintech startup in the US can be an exciting and rewarding journey. By following the steps outlined in this post and partnering with a comprehensive embedded finance platform like Cybrid, you can build and launch innovative financial solutions that meet the evolving needs of your customers.

If you're a developer, getting started with Cybrid is easy. Review the technical documents and guides to gain a deeper understanding of the platform's capabilities, and experiment with the Sandbox to see firsthand how it can help you build and scale your fintech product.

For business leaders looking to explore the potential of a partnership with Cybrid, book a demonstration with their sales team to learn more about the platform and how it can accelerate your fintech startup's growth. With Cybrid's powerful technology, expert support, and comprehensive resources, you can confidently take your fintech startup to new heights.