Embedded Finance is a term that is not new, but is certainly gaining significance in the world of finance and technology. But what exactly is it, and why is it important? In this post, we'll take a closer look at what Embedded Finance is, why it matters, and how it's being used by companies today.

At its core, Embedded Finance is a new way of thinking about financial services. Rather than treating financial services as a separate and distinct offering, Embedded Finance integrates them into everyday products and services. This means that instead of having to go to a bank or other financial institution to access financial services, consumers can now access them through the products and services they already use.

|

Put simply, embedded finance is the placing of a financial product in a nonfinancial customer experience, journey, or platform. |

There are many benefits to this approach, both for businesses and consumers. For businesses, Embedded Finance can provide new revenue streams and help to differentiate their products and services in a crowded market.

By offering financial services as part of their offering, businesses can provide value to their customers that their competitors may not be able to match. This can help businesses to stand out and attract new customers. Many companies are starting to use Embedded Finance in their operations and the five common uses of Embedded Finance, as outlined in the Forbes article on Embedded Finance are:

-

- Buy now, pay later

- Point-of-service lending

- Integrated insurance services

- Investments and trading

- Fintech-as-a-service

As more and more companies start to use Embedded Finance, it is likely that we will see even more creative and innovative use cases for this new approach to financial services. Some of the key benefits of this new approach include:

-

- Improved customer experiences: By offering financial services as part of their products and services, businesses can improve the customer experience and make it easier for customers to access the financial products they need.

- Increased revenue streams: Embedded Finance can provide businesses with new revenue streams, which can help them to grow and expand.

- Increased competition: By offering financial services, businesses can differentiate themselves from their competitors and attract new customers.

- Increased financial inclusion: Embedded Finance can make it easier for people who may not have access to traditional financial services to access the financial products they need.

- Greater innovation: The integration of financial services into everyday products and services can drive innovation and lead to the development of new and better financial products and services.

Overall, the benefits of Embedded Finance are numerous and significant, and it is a trend that is worth paying attention to. As more and more businesses start to use Embedded Finance, it is likely that we will see even more benefits and opportunities arise. At Cybrid, we're looking to make it easier for companies to integrate Embedded Finance by providing the FinTech infrastructure required to bring products to market.

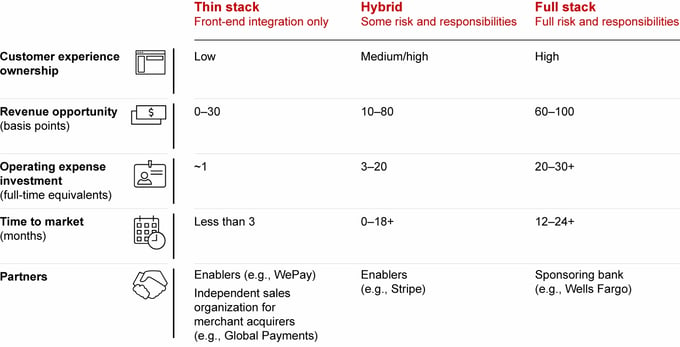

By providing the backend as a service for KYC onboarding, on/off ramp, ledgering, and cash accounts including crypto trade and custody, we enable businesses to easily deploy a range of Fintech products. From a model perspective, using the categories laid out by Bain & Company, Cybrid would empower Thin and Hybrid stacks.

Source: Embedded Finance - Bain.com

However, it's important to recognize that there are also some potential challenges and drawbacks to Embedded Finance. For example, there may be concerns about privacy and data security, as well as concerns about regulatory compliance. Fortunately, initiatives such as Open Banking and companies such as Cybrid are helping to address these challenges and make it easier for businesses to offer financial services in a secure and compliant manner. Our CEO also has worked closely with the Open Banking initiative in the past and has first-hand experience with the benefits it can provide.

Despite these challenges, Embedded Finance is a trend that is worth building around. It offers many benefits for businesses and consumers, and it is likely to continue to grow and evolve in the coming years. Whether you're a business owner, a consumer, or simply someone who is interested in finance and technology, it's a trend that you should keep an eye on.

At Cybrid, we understand the complexities and challenges of integrating financial services into your business offerings. Our mission is to simplify this process, providing an effortless bridge between your business and the financial world.

-1.webp?width=300&name=Core%20Concept%20Embedded%20Finance%20(1)-1.webp)