In the rapidly expanding universe of financial technology, understanding the flow of funds is a linchpin for business owners navigating the intricate waters of fintech solutions. At Cybrid, we are committed to demystifying the paths your business finances take, ensuring an impeccable level of transparency, trust, and compliance from the outset. This article is designed to guide business proprietors through the foundational step of our onboarding process: defining and documenting the flow of funds.

What is Flow of Funds?

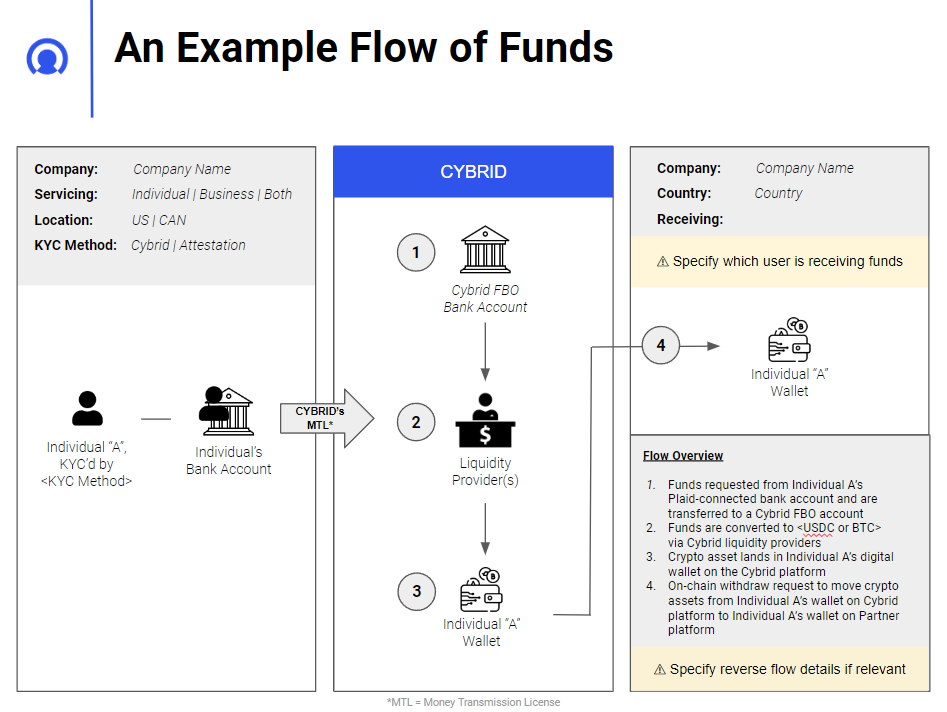

The Flow of Funds (FoF) is the financial blueprint that traces the journey of capital within an economic ecosystem or an entity. It’s pivotal for business owners and fintech companies to decode this flow to optimize transaction processes, manage risks effectively, and ensure strict adherence to regulations and policies. A basic overview of the flow of funds will identify who is involved, how the funds are being transmitted, and for what purpose.

Why is it Important for Business Owners?

Transparency and reliability in financial technology are grounded in documenting the Flow of Funds (FoF). This detailed recording offers business owners clear insights into transaction mechanics, enhancing their confidence in the company’s financial dealings. A thorough understanding of fund movements fortifies trust, solidifying the relationship between business owners and fintech service providers.

Additionally, possessing an intimate knowledge of the FoF is vital for achieving legal alignment and ensuring all financial transactions adhere to prevailing mandates and regulations. This adherence is not only pivotal for avoiding legal ramifications but also crucial for maintaining operational integrity and upholding the organization’s standing in the marketplace.

Moreover, a well-defined FoF is key to identifying and mitigating risks effectively. It allows businesses to proactively bolster their financial structures against potential vulnerabilities, safeguarding their interests and ensuring sustainable growth in an ever-evolving fintech environment.

Defining and Documenting Flow of Funds

For business owners, a structured approach to defining and documenting the FoF is paramount. Here’s a sequential guide to accomplish this:

1. Identify Sources and Applications:

- Determine potential origins and endpoints of funds within your business operations.

- Define the nature and objectives of each transaction.

2. Map Transactional Channels:

- Detail every phase in the transaction journey, from inception to conclusion.

- Enlist intermediary entities and financial instruments engaged in the transactions.

3. Embed Regulatory Frameworks:

- Integrate applicable regulatory and compliance standards pertinent to each transaction type.

4. Periodic Review and Update:

- Regularly revisit and update the FoF documentation to integrate modifications in transactional methodologies or regulatory alterations.

- Keep all relevant stakeholders abreast of any revisions in the FoF.

Significance in the Onboarding Process

For business owners, understanding the flow of funds is integral during the onboarding process, as it:

- Facilitates Informed Decision-making: Offers comprehensive insights into the financial ecosystem, enabling strategic planning and execution.

- Optimizes Operational Workflow: Ensures seamless, streamlined operational flow, reducing inconsistencies and delays.

- Enhances Compliance Alignment: Embeds compliance within the FoF, shielding both the business and the organization from regulatory discrepancies and financial pitfalls.

Conclusion

For business proprietors stepping into the fintech domain, mastering the flow of funds is a fundamental endeavor. It not only ensures a seamless, transparent, and compliant financial journey but also fortifies trust and reliability between businesses and their fintech partners. In the dynamic arena of fintech, maintaining a steadfast grasp on the financial trajectories is crucial, and we are your steadfast partners in ensuring a smooth and informed navigation through these trajectories.