In the rapidly evolving world of embedded finance trends, the terms "on-ramps" and "off-ramps" have become buzzwords in the community. Simply put, on-ramps are the pathways through which users can convert their fiat currency into cryptocurrency, such as USD to USDC, while off-ramps allow them to convert their crypto assets back into fiat, such as USDC to USD. A critical aspect that ensures the safety, legality, and smooth operation of these pathways is the Know Your Customer (KYC) process, which is part of a broader customer identification program.

Why is a KYC Process Essential for On Ramps and Off Ramps?

- Regulatory Compliance and Legal Requirement

KYC is not just a best practice; it's a legal requirement in many jurisdictions. Laws and regulations often mandate the identification of the sender for transactions over a certain value. This is evident in the $3,000 Placement Rule, which requires financial institutions to verify and record the identity of each cash purchaser of money orders and bank, cashier’s, and traveler’s checks in excess of $3,000. This is why some on-ramp and off-ramp services may allow for initial transactions without a full KYC identity check when first onboarding.

However, as users continue to use the service, they will eventually be required to provide necessary information, such as their Social Security Number, to comply with these regulations. Failing to adhere to these rules can result in legal penalties and a tarnished standing with regulatory bodies. The stark reality is verification of identity is required to participate in payments and banking infrastructure.

- Enhanced Fraud & AML Security

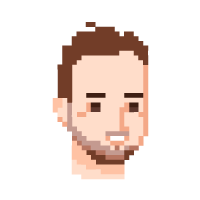

KYC procedures, including the customer due diligence (CDD) process, are crucial for reducing fraud risks in cryptocurrency transactions. At Cybrid, we conduct a comprehensive KYC process to verify the identities of our end-users, including document checks and database verifications. This is part of our customer due diligence program.

We assess whether the individual is a Politically Exposed Person (PEP) or Head of an International Organization (HIO), and perform sanction checks and media screenings. Transactions are then securely processed through our banking partners, with all identity data from KYC matched with the funding account's PII. Jurisdictional limits for enhanced due diligence, such as requiring a Social Security Number, are also respected.

Furthermore, we employ robust tools to score each fiat transaction and crypto wallet for fraud and AML risks. Transactions or wallets flagged as high-risk are either rejected or reviewed by our compliance team, ensuring a safe and trustworthy environment for our users.

- Streamlining the User Experience

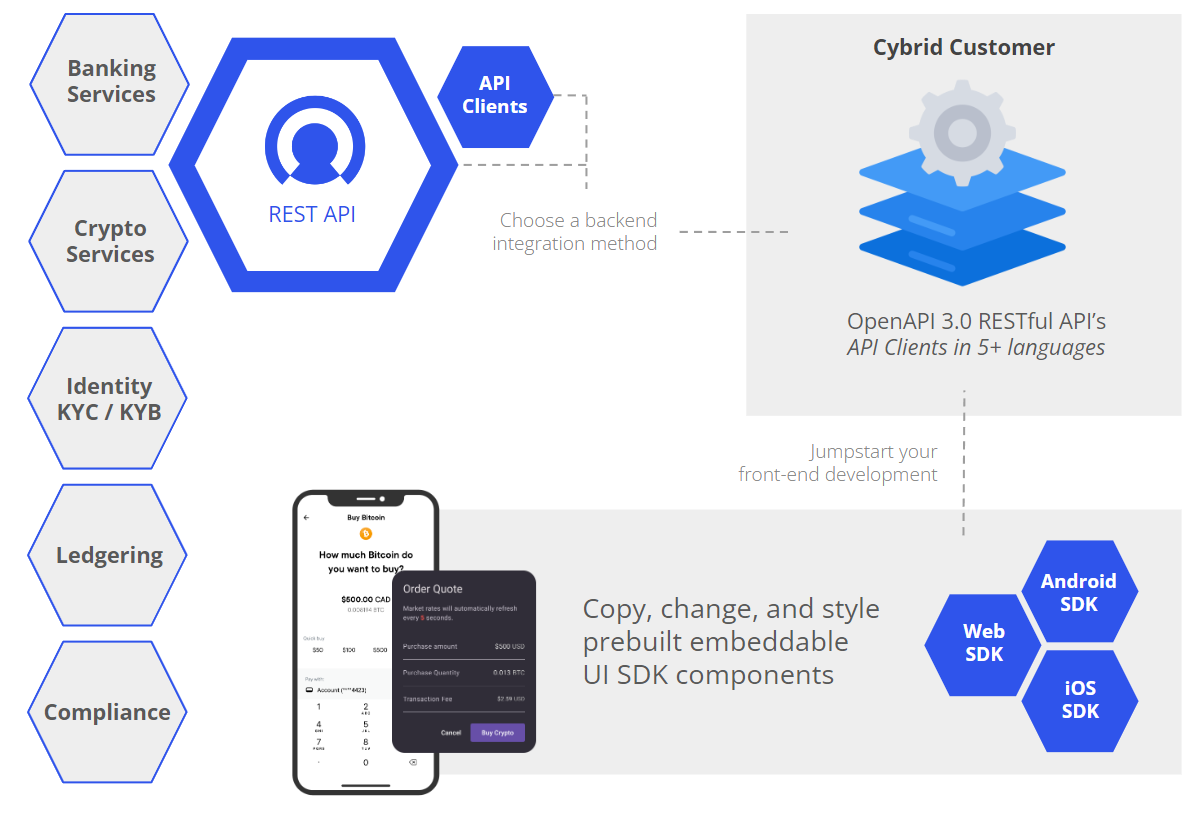

There are various forms of onramps and offramps available in the market, ranging from simple drop-in widgets to more embedded options. Simple drop-in widgets provide a straightforward way for users to convert fiat to crypto and crypto to fiat, often from credit cards. However, they may lack the flexibility and functionality needed for a fully integrated, end-to-end payment experience.

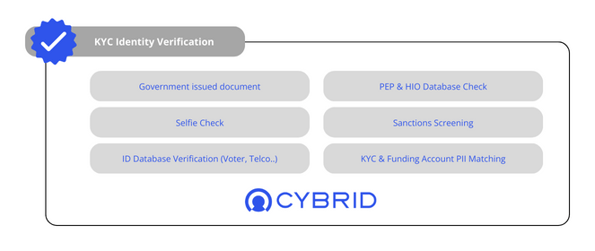

On the other hand, more embedded options, like Cybrid, offer a robust and seamless experience. With Cybrid, businesses can leverage our comprehensive API & SDK infrastructure to provide their users with a seamless and integrated solution for their payment needs. This enables a smoother user journey, from KYC verification, to money movement via instant ACH and more, to crypto transaction processing, all within a secure and compliant environment.

In conclusion, KYC protocols play a crucial role in ensuring the safety, legality, and smooth operation of cryptocurrency on-ramps and off-ramps. By adhering to these protocols, platforms can build trust with their users, reduce the risk of fraud, and provide a streamlined user experience. As the world of cryptocurrencies continues to evolve, the importance of KYC in maintaining a safe and compliant ecosystem cannot be overstated.