The digital world is changing the way we handle money, and digital currencies are becoming more and more common in global business. USDC, a digital coin tied to the US dollar, is leading the way in this new era. It's a stablecoin that helps people make safe and fast transactions all over the world.

Understanding USDC

USD Coin, or USDC, is a kind of cryptocurrency that is always worth one US dollar. This is because it is backed by real US dollars that are held in regulated US banks. This stability makes USDC a great choice for businesses and people who want to send money around the world without dealing with the ups and downs of other digital coins.

The Power of USDC in Global Payments

When you use USDC for global payments, you can send and receive money in real time, without waiting for banks or other middlemen to process the transaction. This is possible because USDC works on a programmable dollar platform that can easily connect with different financial systems and services. You can also keep your USDC in a programmable wallet, which lets you manage your money from anywhere in the world.

Another great thing about USDC is that it's safe and transparent. All transactions made with USDC are recorded on a blockchain, which is a public ledger that can't be changed. This means that anyone can check and make sure that a transaction is real and correct.

USDC in Action: The Case of Venezuelan Aid

In the midst of a crisis that left Venezuela grappling with significant economic challenges, USDC emerged as an unlikely hero, showcasing its potential in international affairs.

In November 2020, the stablecoin issuer Circle, in partnership with the U.S. government, leveraged the power of USDC to support the Venezuelan people in a time of dire need. This partnership served to bypass Nicolás Maduro's regime and support the Bolivarian Republic of Venezuela led by Juan Guaidó, whom many countries, including the United States, recognize as the legitimate President of Venezuela.

In a country where the local currency had seen over 2,358.5% inflation in 2020 alone, the introduction of USDC offered Venezuelans a stable and usable currency. In this context, the value of USDC extended far beyond its status as a stablecoin. It became a lifeline, a means of economic survival in a country gripped by hyperinflation.

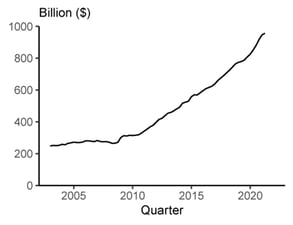

A Growing Appetite for the US Dollar

There is a growing demand for the US dollar worldwide. Over the past few decades, foreign holdings of the US dollar have increased by billions, highlighting the need for a digital counterpart that can facilitate global transactions in the world's primary reserve currency. This is where USDC comes in, providing a digital solution for handling US dollar transactions on a global scale.

USD held in Foreign Holdings, Source: Federal Reserve

Utilize Blockchain Based Financial Services with USDC

In the emerging digital currency ecosystem, decentralized services and exchanges like Uniswap are becoming vital components of the landscape. Offering instantaneous exchange, improved rates, and frictionless transitions between currencies, these platforms are greatly enhancing the functionality and versatility of digital currencies like USDC and EUROC.

One of the most important impacts of Uniswap and similar DEX platforms is their ability to facilitate co-existence among different currencies, including stablecoins like USDC and EUROC. With these platforms, users can quickly and easily convert one currency to another, providing a solution to the historic problem of currency interoperability.

But the potential of USDC doesn't stop there. In addition to these decentralized financial services, you can now leverage USDC to access traditional financial services, such as mortgages. At usdc.homes, you can get a mortgage backed by USDC, opening up new possibilities for homeownership in the digital age.

Leveraging Cybrid for USDC Transactions

But to truly take advantage of USDC and all its benefits, you need the right tools. That's where Cybrid comes in. Our platform offers a suite of services via OpenAPI, making it easy to switch between USD and USDC. We have Software Development Kits (SDKs) for web, Android, and iPhone, ensuring that our platform is accessible no matter what technology you're using.

What sets Cybrid apart is not just our technology, but also our commitment to user-friendly experiences. Our documentation is among the best in the industry, providing clear and concise instructions that help you get the most out of our platform. We verify identity, connect to end user's funding accounts, move money, and hold funds in FBO accounts for both USD and CAD. This makes your global transactions that take place in United States and Canada smooth and easy, allowing you to focus on what matters most - your business.