In the expanding universe of digital assets, the term "stablecoin" often is used. What is a stablecoin? Simply put, it's a type of cryptocurrency designed to have a stable value, pegged to a traditional currency or commodity. In this category, Circle's USDC stands out, gaining traction in global remittance.

USDC's Foundation: A Digital Dollar

The questions, "is USDC fully reserved?" and "is USDC safe?" resonates with many crypto enthusiasts; so we want to answer them!

For every USDC in circulation, a tangible U.S. dollar or its equivalent in assets like short-term U.S. Treasuries is held as collateral. Such a framework ensures that converting USDC to USD is seamless, giving assurance to holders about the genuine asset backing their digital dollar. USDC is always redeemable 1:1 for US dollars. USDC reserves are held in the management and custody of leading US financial institutions, including BlackRock and BNY Mellon.

The 2023 USDC Depeg: No cause for panic

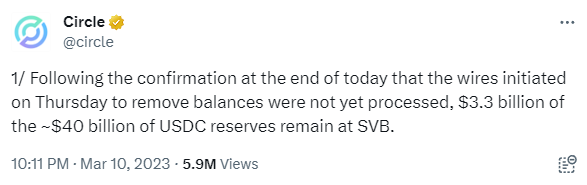

An unprecedented event in 2023 highlighted the vulnerabilities even robust stablecoins face. The collapse of Silicon Valley Bank (SVB), where a significant portion of USDC's reserves were held, sent shockwaves across the crypto community.

Panic ensued among USDC holders, leading to a rush of exiting trades on decentralized platforms like UniSwap and Curve. This frenzied activity saw USDC's trading price dip below its traditional peg to 89 cents, despite Circle maintaining its open redemption at $1. The discrepancy presented an arbitrage opportunity: buying USDC for less than a dollar in the open market and redeeming it for a full dollar through Circle API.

While USDC transactions on the blockchain operate without interruption, running 24/7/365, the issuance and redemption of USDC is often bounded by the traditional working hours of the U.S. banking system. This distinction became particularly evident during the SVB collapse.

While traders could swiftly and continuously move and trade USDC across different protocols and wallets irrespective of time, those looking to redeem their USDC for U.S. dollars or inject more liquidity into the system by minting new USDC faced the temporal limitations of traditional banks. This disparity underscores the unique challenges stablecoins like USDC navigate: bridging the gap between the traditional, regimented world of fiat finance and the round-the-clock, borderless realm of blockchain.

It's an enlightening reminder of how interconnected the old and new worlds of finance truly are. As decentralized finance platforms and cryptocurrencies push the boundaries of financial accessibility and flexibility, they remain tethered, to some extent, to the conventions of the traditional systems they seek to augment or even replace.

The Circle USDC Reserve: A Closer Look

Building trust and transparency in the world of stablecoins, especially USDC, requires a deep dive into the reserves that back these tokens. Circle, as the issuer of USDC, has always emphasized the importance of maintaining full reserves and regularly conducts attestations to maintain user trust.

One of the significant pillars supporting USDC's robust reserve is its association with BlackRock, a globally recognized name in asset management. BlackRock offers extensive details about some of the funds that contribute to the USDC reserve. For individuals keen to delve deeper into the specifics, BlackRock provides intricate details about these funds on their platform. Explore more about the BlackRock fund that backs USDC here.

Additionally, to foster transparency and assure holders of the stablecoin's integrity, Circle conducts monthly attestations of their USDC reserves. These attestations, performed by independent accounting firms, ensure that for every USDC in circulation, there's a corresponding U.S. dollar in reserve. By combining BlackRock's reputation and the transparency offered by Circle's monthly attestations, USDC stands as one of the most reliable stablecoins in the crypto industry.

Harness the Power of Cybrid

At its core, Circle USDC is more than just a stablecoin; it's a beacon of trust and stability in the ever-fluctuating world of cryptocurrency. Its unwavering 1:1 peg to the U.S. dollar is not by accident but is a testament to the relentless commitment and effort of Circle in ensuring its robustness and reliability. From stringent reserve management to fostering transparency through partnerships with giants like BlackRock and BNY Mellon, Circle has built a formidable foundation for USDC in the decentralized finance space.

Looking to access USDC and it's formidable foundation? With Cybrid, seamlessly bridge the gap between digital assets and fiat currency. Whether you're looking to access USDC liquidity or smoothly transition between USDC and traditional money forms, Cybrid offers an intuitive, secure, and efficient platform to empower every move you make in the financial landscape. Experience unparalleled ease and confidence with Cybrid, your go-to for all USDC and fiat financial maneuvers.