Need some context? Check out our post on What is embedded Finance?

The rise of digital real-time payments

The global payments industry is undergoing significant changes, driven in part by the rise of embedded finance. This trend has been fueled by technological innovations and evolving customer preferences, as well as the increasing digitization of the economy.

Digital payments, including mobile payments and online and offline transactions, are growing at a faster rate than traditional payment methods. Between 2015 and 2020, digital payments experienced a compound annual growth rate of 15 percent, and by 2025 it is expected that mobile payments will represent nearly half of all digital payments. The COVID-19 pandemic has also accelerated the shift towards digital payments, with the use of contactless payments increasing significantly.

The rise of digital payments and embedded finance has led to increased competition among providers, with non-financial firms entering the space and traditional financial institutions facing pressure to digitize and offer new financial products and services. This has resulted in a diverse and rapidly evolving landscape, with a wide range of players offering a variety of payment options and financial services.

One trend within the global payments industry is the increasing use of real-time payments. The volume of real-time payment transactions is expected to triple by 2025, as consumers and businesses seek faster and more convenient payment options. This trend is closely linked to the rise of embedded finance, as real-time payments can enable new financial products and services to be offered within non-financial platforms.

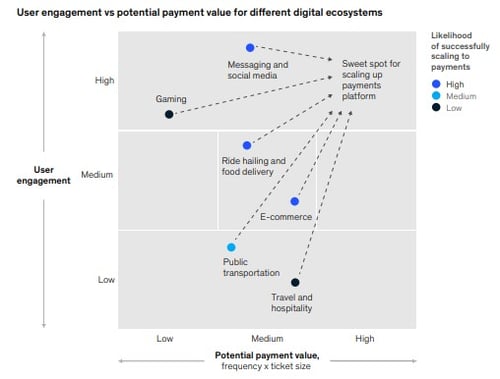

The below image is from the October 2022 McKinsey report on Global Payments, and is an exhibit that shows Social-media, e-commerce, gaming and ride-hailing platforms are well placed to scale up into digital payments ecosystems and be distributors of multiple financial products.

As a result of the above, the use of open banking APIs platforms to act as infrastructure-as-a-service, like Cybrid, to enable the development of new financial products and services is also on the rise. Our APIs allow third-party developers to access bank data, leverage payment gateways, and build new financial products and services on top of existing infrastructure, without the need to stitch multiple services together and continue to maintain that infrastructure.

By using solutions like Cybrid, companies are able to greatly scale down the technical requirements of the innovative projects, allowing a greater focus of time and budget on product-market fit and associated problem solving.

.png?width=600&height=338&name=Cybrid%20API%20Platform%20(5).png) [Click for an overview of the Developer Platform]

[Click for an overview of the Developer Platform]

Cliff Note: Cryptocurrency's role in Global Payments

While cryptocurrencies currently represent a small share of the overall payments market, their use is growing. Cryptocurrencies have the potential to disrupt traditional payment companies that fail to adopt them, but also bring their own set of challenges, including regulatory issues and security concerns - which Cybrid's API platform helps to alleviate. Current challenges aside though, cryptocurrencies may also play a role in the future of embedded finance, as they can enable new financial products and services to be offered using decentralized platforms via stable coins like USDC.

Want to learn more about how cryptocurrency is impacting Embedded Finance and Global Payments? Read more on USDC global use cases or the latest USDC news!